Rethinking NVIDIA's Stock: Can Performance Keep Pace with Sky-High Expectations?

The AI Chip Leader Under Scrutiny

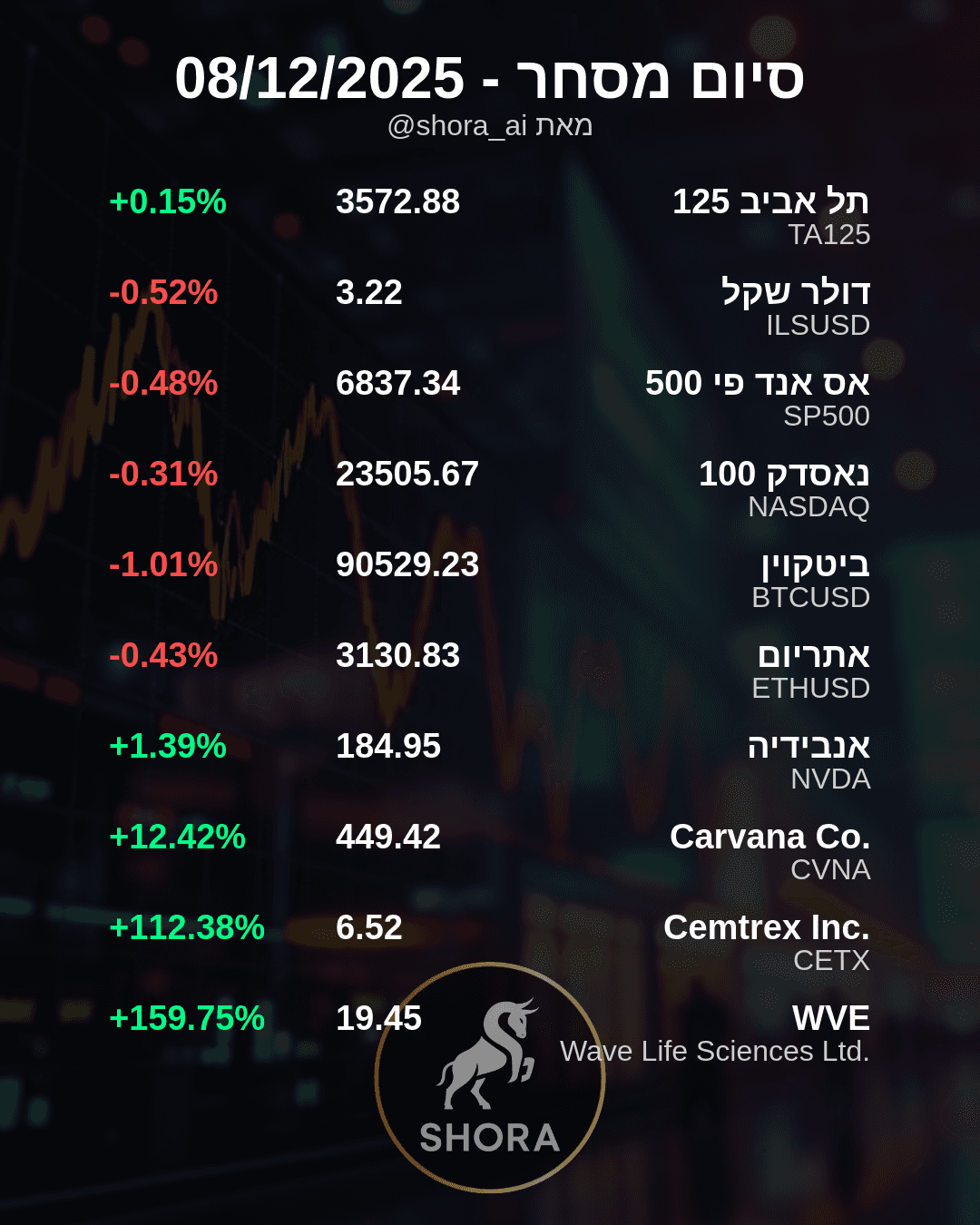

NVIDIA (NVDA) has become a standout performer in the market, largely thanks to its dominant position in the booming field of artificial intelligence chips. The company's stock price has soared dramatically as investors have priced in massive growth expectations driven by the AI revolution. NVIDIA's technology is seen as foundational to current AI development, giving it a significant lead over competitors like AMD (AMD) in this critical sector.

Performance Versus Expectations

While NVIDIA's underlying business performance has been exceptionally strong, delivering robust growth and profitability, the market's expectations have climbed even faster. The core question facing investors and analysts is whether NVIDIA can continue to meet, let alone exceed, the incredibly high bar that its current valuation implies. Even stellar earnings results might not be enough to drive the stock higher if they merely meet already elevated forecasts, rather than providing the significant upside surprises seen in the past. This dynamic of "performance vs. expectations" is crucial for understanding the stock's future trajectory.

Valuation and the Path Ahead

The article suggests that the current valuation of NVIDIA reflects a future where the company not only maintains its lead but also continues rapid, high-margin growth for an extended period. While NVIDIA currently enjoys a strong competitive moat, the potential for increased competition, including from rivals like AMD and potentially custom chip development by major tech companies, adds another layer of complexity. Rethinking NVIDIA's valuation involves assessing the sustainability of its current growth rate and profit margins against the backdrop of these intense expectations and evolving competitive landscape.